Explore the capabilities we specialise in at Neural Alpha

Neural Alpha stands at the forefront of ESG innovation, offering tailored and scalable solutions to help businesses navigate the fast changing world of ESG.

Research & insights

Discover the latest in our quest to unveil industry trends and showcase new perspectives in the financial ESG, tech, and sustainability industry.

.jpg)

James Lawson joins Neural Alpha Advisory Board

Appointment strengthens Neural Alpha’s next-generation research, due diligence and benchmarking workflows across listed and private assets

James Lawson joins Neural Alpha Advisory Board

.jpg)

Sustainable Investor - AI in SI: Own the Methodology, Lease the Infrastructure

Sustainable investors should focus on making their investment processes and strategies ‘AI-ready’, says James Phare, CEO of Neural Alpha.

Sustainable Investor - AI in SI: Own the Methodology, Lease the Infrastructure

.jpg)

Neural Alpha shortlisted for ESG Investing 2026 Awards in Best ESG & Sustainability Analytics Platform

🏆 AWARD NOMINATION NEWS

Neural Alpha shortlisted for ESG Investing 2026 Awards in Best ESG & Sustainability Analytics Platform

.jpg)

Webinar: Do's & Don'ts of AI-Powered Sustainability: Applications in Business and Finance

Webinar: Do's & Don'ts of AI-Powered Sustainability: Applications in Business and Finance

.jpg)

Neural Alpha Secures European Space Agency Funding to Combat Greenwashing with Satellite Technology

Neural Alpha Secures European Space Agency Funding to Combat Greenwashing with Satellite Technology

.jpg)

Conducting the world’s largest AI powered corporate nature assessment for TNFD

In late September 2025, the TNFD, a global initiative to standardise nature-related financial disclosures, published its first ever Status Report, marking two years since its recommendations were finalised.

Conducting the world’s largest AI powered corporate nature assessment for TNFD

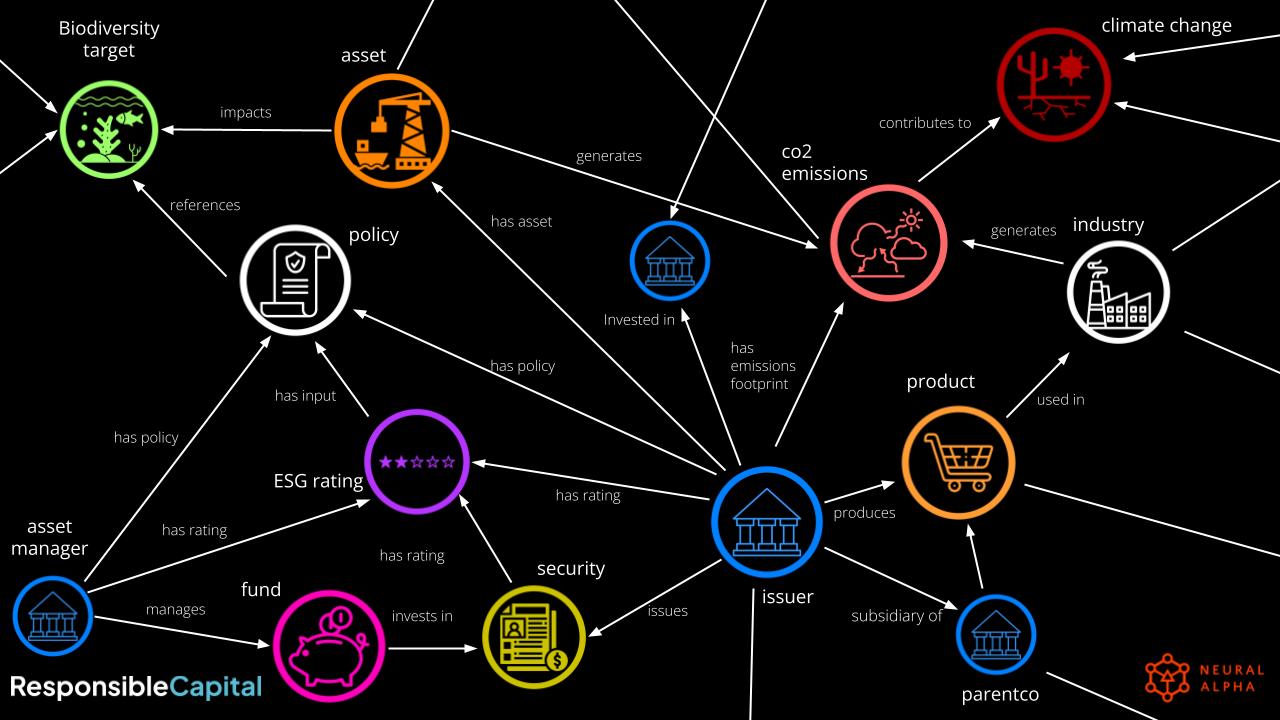

Why do we use Knowledge Graphs and GraphRAG extensively at Neural Alpha in our sustainability work?

.jpg)

Why do we use Knowledge Graphs and GraphRAG extensively at Neural Alpha in our sustainability work?

Industry leaders are increasingly leveraging Knowledge Graphs for sustainable advantage.

Rising Tide: Are Companies Ready for the Ocean Accountability Era?

.jpg)

Rising Tide: Are Companies Ready for the Ocean Accountability Era?

Ahead of the UNOC 3 Ocean Conference, Responsible Capital ran a quick stocktake across 60 global companies to assess the state of ocean-related reporting.

Turning Frameworks into Insight: Applying Responsible Capital to the WEF Nature Positive Guide

.jpg)

Turning Frameworks into Insight: Applying Responsible Capital to the WEF Nature Positive Guide

How do you turn frameworks like the World Economic Forum Nature Positive Guide into actionable insight? We put Responsible Capital to the test—using real disclosures to analyse FTSE100 nature-related risk at scale

Spanish Blackout April 2025 - what can we learn about Red Electrica's risk mitigation strategy?

.jpg)

Spanish Blackout April 2025 - what can we learn about Red Electrica's risk mitigation strategy?

A reblog of a linkedin post analysing Red Electrica, the Spanish national grid operator, and their green policies, business continuity plans and energy mix.

New White Paper: Time for ESG Investors to Embrace European Defence Companies?

.jpg)

New White Paper: Time for ESG Investors to Embrace European Defence Companies?

As geopolitical tensions rise and Europe faces renewed threats to its democratic values, ESG investors are being urged to rethink their stance on defence stocks. In our latest white paper, Time for ESG Investors to Embrace European Defence Companies?, Neural Alpha CEO James Phare challenges long-held assumptions and exclusionary practices within sustainable investing.

James Lawson joins Neural Alpha Advisory Board

.jpg)

James Lawson joins Neural Alpha Advisory Board

Appointment strengthens Neural Alpha’s next-generation research, due diligence and benchmarking workflows across listed and private assets

Sustainable Investor - AI in SI: Own the Methodology, Lease the Infrastructure

.jpg)

Sustainable Investor - AI in SI: Own the Methodology, Lease the Infrastructure

Sustainable investors should focus on making their investment processes and strategies ‘AI-ready’, says James Phare, CEO of Neural Alpha.

Neural Alpha shortlisted for ESG Investing 2026 Awards in Best ESG & Sustainability Analytics Platform

.jpg)

Neural Alpha shortlisted for ESG Investing 2026 Awards in Best ESG & Sustainability Analytics Platform

🏆 AWARD NOMINATION NEWS

Neural Alpha Secures European Space Agency Funding to Combat Greenwashing with Satellite Technology

.jpg)

Neural Alpha Secures European Space Agency Funding to Combat Greenwashing with Satellite Technology

Conducting the world’s largest AI powered corporate nature assessment for TNFD

.jpg)

Conducting the world’s largest AI powered corporate nature assessment for TNFD

In late September 2025, the TNFD, a global initiative to standardise nature-related financial disclosures, published its first ever Status Report, marking two years since its recommendations were finalised.

Google recognises Neural Alpha as leader in Responsible AI

.jpg)

Google recognises Neural Alpha as leader in Responsible AI

Neural Alpha is proud to share that Google has recognised us as a leading innovator in Responsible AI, spotlighting our work in sustainability intelligence, ESG analytics, and agentic AI systems in its landmark 2025 report, The SMB AI Playbook: Driving Real Value in EMEA.

Webinar: Do's & Don'ts of AI-Powered Sustainability: Applications in Business and Finance

.jpg)

Webinar: Do's & Don'ts of AI-Powered Sustainability: Applications in Business and Finance

Automating Human Rights Assessments with AI

.jpg)

Automating Human Rights Assessments with AI

Join us for an exciting webinar where we explore the intersection of artificial intelligence and human rights compliance.

Due diligence towards deforestation-free finance

.jpg)

Due diligence towards deforestation-free finance

In this webinar, Ben Levett discusses how to apply deforestation due diligence guidance and how Trase Finance data products can power commodity trader assessments.

Sustainable finance taxonomies

.jpg)

.jpg)

Sustainable finance taxonomies

In this webinar hosted by ISKO, Neural Alpha founder James Phare and ESG Researcher Dan Burke-Ward discuss the role of taxonomies in sustainable finance and how the Neural Alpha product suite centralises taxonomies for interoperability and reporting and the connection of various data types.

Toward sustainable finance in Asia: Due diligence and deforestation

.jpg)

Toward sustainable finance in Asia: Due diligence and deforestation

In this webinar, Ben Levett discusses why location-specific analysis is so important for proper deforestation due diligence and outlines how Trase Finance can help conduct TNFD LEAP-FI style assessments of commodity traders.

The Connectivity Hub

.jpg)

The Connectivity Hub

Neural Alpha is working with the Stockholm Environment Institute to build out a knowledge-graph-based connectivity tool that leverages its expertise in large language models (LLMs) and data engineering to add value to heterogeneous data sets of research and other scholarly articles.

Lucida

.jpg)

Lucida

Showcasing our ability to deliver sophisticated backend infrastructures, Neural Alpha delivered the database, ETLs and API powering Lucida’s advanced supply chain and deforestation analysis.

Refinitiv

.jpg)

Refinitiv

Utilising our expertise in knowledge graphs, supply chains and sustainability, Neural Alpha was the obvious choice to help Refinitiv explore proof of concept applications of their Big Open Linked Data (BOLD) platform to ESG use-cases

Minderoo - plastic waste makers index

.jpg)

Minderoo - plastic waste makers index

Working with a number of global partners, Neural Alpha led the development and data engineering on the novel supply chain mapping behind the inaugural Plastic Waste Makers Index.

Orbitas / climate advisors trust

.jpg)

.jpg)

Orbitas / climate advisors trust

Employing our strong data engineering and data integration capabilities, Neural Alpha helped to deliver the Orbitas platform and landmark report on the climate transition risks of agriculture.

WWF-UK financed deforestation analysis

.png)

.jpg)

WWF-UK financed deforestation analysis

Neural Alpha provided an analysis on the scale and channels of UK financial sector exposure (both direct and indirect) to deforestation risk in Indonesian palm and Brazilian soy and beef, as WWF sought to strength commitments in the UK Environment Bill.

Ready to drive sustainable growth in your business?

Contact us now to start your innovation & sustainability journey to arrange an exploratory conversation